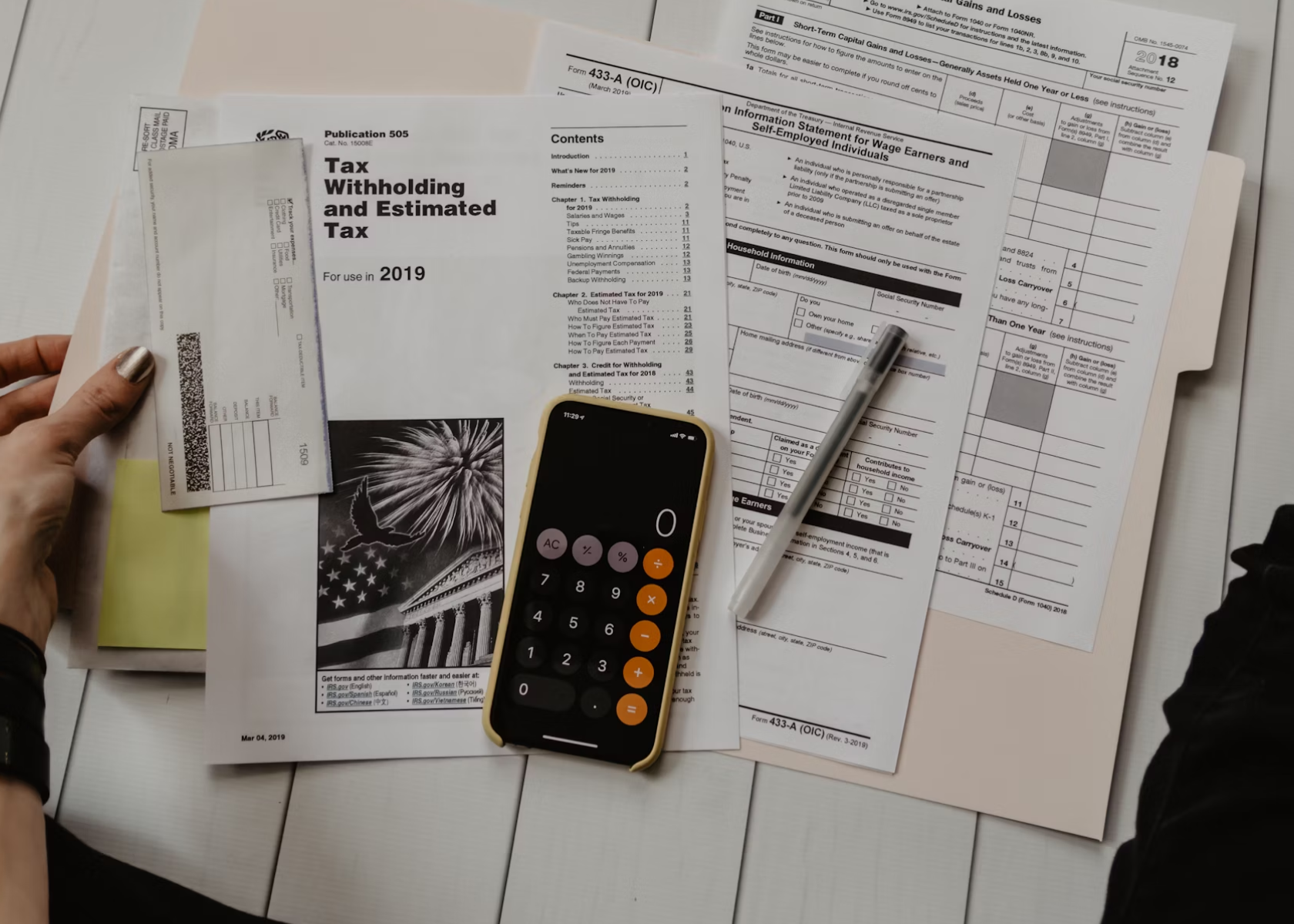

What is KBA, and why does it matter?

KBA is a security measure that verifies a signer's identity by prompting them to answer questions based on public records (think previous addresses or loan details). This method ensures that the person signing the document is indeed who they claim to be. For tax professionals, KBA is a legal requirement. The IRS mandates KBA for electronically signed Forms 8878 and 8879, which exist to authorize the e-filing of an individual’s tax returns.The old way:

Historically, incorporating KBA into your tax workflow meant relying on separate platforms, leading to:- Manual data transfers between systems

- Increased risk of errors

- Additional costs for standalone KBA services

- Disjointed client experiences

The Keeper way:

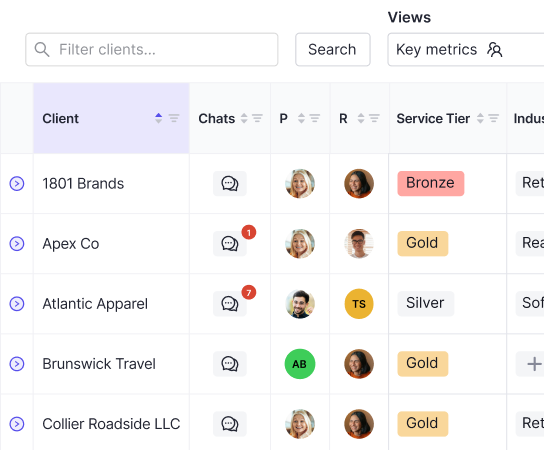

Keeper’s e-signature features makes sending, signing, and verifying documents simple. The highlights include:- Uploading documents directly from a client’s tax return page in Keeper.

- Adding multiple signers and customize the signing order easily.

- Customizing fields with various types (text, signature, date, etc.), ensuring all necessary information is clearly requested. Make templates so you don’t have to reinvent the wheel each tax season.

- Optional KBA verification enhances security, verifying the signer’s identity through personal information and public records.

How it works:

- Enable KBA verification simply by selecting "KBA signature required" from the Role drop-down when adding recipients.

- Pay per signature: affordable pricing ($1 per signature in the US) covers the cost of verification.

- Pre-fill optional client details (such as Name, Address, Date of Birth, and SSN) or let clients provide this information during the verification process.

- Signers complete verification by answering KBA questions before being redirected seamlessly to sign their document.