What Does an Accounting Virtual Assistant Do?

An accounting virtual assistant (VA) can provide remote assistance with accounting services and bookkeeping. A virtual assistant for certified public accountants and financial advisors can assist with data entry, invoicing, and other activities that you don’t have time to do. Unlike employees, a virtual assistant for CPA firms usually works independently with online communication tools to collaborate. Hiring a remote virtual assistant expands your talent options while offering the flexibility to adjust work hours as needed. There are virtual assistant bookkeeping companies where you can work with a team of virtual assistant talent if you have different types of administrative tasks to delegate. If you need help with both bank reconciliations and data entry, virtual assistant service companies can help find virtual assistant talent. Hiring an accounting virtual assistant can also offer cost savings. By outsourcing, you can avoid many of the costs associated with traditional employees. You can hire an accounting VA to help out during busy year-end and tax seasons, and then not have to worry about finding something for them to do during slow times.Hiring a VA vs. an In-House Employee

Once you’ve decided to delegate accounting tasks, you need to decide who to delegate them to. You could hire another employee, but in-house employees come with additional costs. Most employees expect benefits like health insurance, retirement contributions, and paid time off. While employees offer the convenience of face-to-face interactions, having another employee adds to overhead costs. You’d need to have additional office space, more equipment, and higher utility bills. Hiring an accounting virtual assistant might make more sense. A virtual bookkeeping assistant can be hired on an as-needed basis. Having this kind of flexibility ensures that you can quickly adjust your team according to demand. Some potential drawbacks of working with a virtual assistant bookkeeper:- Communication issues: Working with remote team members in different time zones can be challenging.

- Security concerns: Finding someone you can trust with confidential virtual assistant bookkeeping could be difficult.

- Language barriers: Working with a bookkeeping virtual assistant from another country can lead to misunderstandings.

Streamline Before Delegating

Before you delegate any tasks, you’ll want to take an inventory of everything to determine which accounting tasks make sense to delegate. You can use the Focus Funnel from the book Procrastinate on Purpose by Rory Vaden to help classify your tasks into the following categories.1. Eliminate

Eliminate anything that doesn’t create value. Maybe you’ve been doing an accounting task for years just because that’s the way the firm has always done it.2. Automate

If you can’t eliminate an accounting task, try automating. Even if you have to purchase applications to help, it might be worth it and could replace the cost of a VA entirely. You should invest in the right tools if you want your firm and virtual assistant bookkeeper to be successful. Consider using Keeper to automate many routine activities. Keeper is trusted by thousands of accountants for CPA and financial advisor practice management.3. Delegate

For accounting tasks like data entry that can’t be automated, the next step is to delegate. Routine, low-complexity tasks like bank reconciliations are perfect for delegation to a bookkeeping virtual assistant.4. Concentrate

When an accounting task can’t be eliminated, automated, or delegated, then you’ll need to handle it now or procrastinate until later. Tackle important tasks soon.5. Procrastinate

If an accounting task makes it to this category, that doesn’t mean you’ll put it off forever. Add it to your to-do list. When it becomes significant enough, send it back through the Focus Funnel.10 Tasks CPAs Can Delegate to a Virtual Assistant

1. Basic Bookkeeping Data Entry

Accurate bookkeeping is a must for any small business owner. The meticulous nature of bookkeeping data entry and accounting tasks can consume a significant portion of your workday. Instead of spending hours on client accounting services, you could easily hand them off for virtual assistant bookkeeping. Delegating routine tasks like data entry will allow you to reclaim time to focus on higher-value services and engagements, especially during year-end and tax season. You’ll be able to use your expertise in money-making areas that bring value to clients, such as tax planning and financial consulting, instead of data entry.2. Bank Reconciliation

Clients rely on your expertise for strategic financial planning—not for hours spent on tedious bank reconciliations. Delegating bank reconciliations to a virtual accounting assistant will allow you to focus on delivering value with more strategic services. Keeper’s integrated file review tools within your client’s close page is great for bank reconciliations. It’s broken up into different sections with dozens of reports to help ensure an accurate month-end for any virtual assistant. In a Keeper customer story with accounting firm On the Books, owner Pam Stocks praises Keeper’s Close Page, saying, “It’s like spell check for bookkeepers.” It allows her to delegate a large portion of the bank reconciliations to her staff.3. Expense Tracking

Managing receipts and expenses can be a time-consuming hassle, but it doesn’t have to be. Delegating expense tracking to a virtual accounting assistant can free up your valuable time for more complex accounting and financial services. Keeper Receipts makes expense tracking easier and more accurate than ever before. A virtual assistant can view the scanned receipt copies your clients upload through the client portal, which then uses AI to extract key information like amounts and dates. Keeper will automatically suggest vendors, categories, and classes and will look through your ledger for potential matches to existing transactions.4. Document Organization

Working with so many clients on various tax and financial engagements, a CPA firm has a lot of documents to manage. Having a thoughtful, yet intuitive, system for file organization is a must to make sure nothing gets misplaced. With all of Keeper’s document organization features, a virtual assistant could easily handle file management. With Keeper, files can be organized into folders and can be attached to objects, such as tasks, vendors, questions, or transactions. Files can be securely shared with team members or clients. In fact, CPAs can record Loom videos or attach training docs to a task one time and rest assured that their VA has something to reference when completing their tasks. Some of the key features of using Keeper for document organization:- Intuitive structure

- Easy accessibility

- Centralized storage

- Secure encryption

- File sharing

5. Creating Financial Reports

After you’ve configured the reports you’ll need for clients, you’ll have to spend time actually running them each month for each client. With proper training, this is something that would be a great task to delegate to a virtual assistant. Keeper’s Reports feature allows you to generate key financial reports within the platform by pulling data from QuickBooks Online or Xero. Completed reports can be printed to PDF, emailed, or published to the client portal for easy access. Measure what matters most for your clients with standard and custom metrics within reports like these:- Executive summary

- Profit and loss statements

- Balance sheets

- Aging reports

- And much more

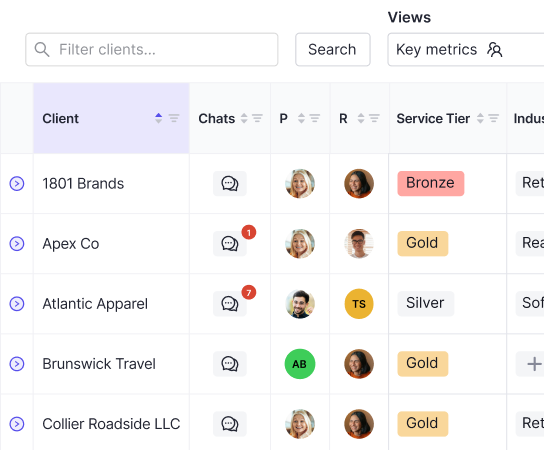

6. Managing Email Communications

Depending on the number of clients you work with, your email inbox could be a nightmare. It can feel like a full-time job just to keep up. Delegating email management to a virtual assistant makes perfect sense. With these features from Keeper’s Client Portal, having a chaotic inbox will be a thing of the past:- Centralized communication: Give clients a single place to communicate.

- Custom-branded: Personalize the portal with your firm’s logo and colors.

- Faster responses: Clients can click an inbox link without a password.

- Automated follow-ups: Schedule automatic emails and text messages.

- Document uploads: Clients upload documents into the portal instead of clogging up your inbox.