The rise of artificial intelligence (AI) has sparked debates about whether bookkeepers and accountants will soon be replaced.

The answer?

AI won’t replace bookkeepers and accountants, but the accounting industry is changing, and it’s changing fast.

AI is revolutionizing the way things are being done by automating repetitive tasks and eliminating critical steps in the workflows previously done by humans.

To stay competitive, professionals must embrace this technology. Those who don’t risk being left behind by accounting firms that harness AI’s potential to deliver faster, smarter services.

Is AI Good Enough to Replace Bookkeepers and Accountants Now?

The short answer is: no.

Artificial intelligence won’t replace bookkeepers and accountants entirely yet.

While AI has become incredibly proficient in automating routine tasks and boosting human efficiency, it still needs human input to work in this space.

AI is currently doing a great job of performing tasks in areas such as:

- Data entry

- Invoice matching

- Transaction categorization

- Financial reporting

Machine learning algorithms are capable of processing huge amounts of financial data fast and finding patterns and anomalies that would take humans hours to spot.

However, these accounting functions aren’t foolproof.

AI tools often struggle with nuance. You might find challenges using AI, for example, in areas such as:

- Interpreting complex tax codes

- Understanding ambiguous entries

- Making judgment calls on sensitive financial strategies

These areas require human expertise, contextual knowledge, and critical thinking that AI can’t replicate.

AI systems also rely on clean, accurate input data to function correctly. Mistakes or incomplete data can lead to errors that require human oversight to resolve.

Lastly, another huge limitation to keep in mind is AI’s inability to build trust with clients.

Financial professionals don’t just crunch numbers—they provide strategic advice, tailored solutions, and emotional reassurance, especially during tough economic times.

These human qualities are irreplaceable.

As of today, AI is merely a tool that complements, rather than replaces, bookkeepers and accountants. You can make it a powerful ally by cutting down time-consuming processes using

bookkeeping workflow automation.

However, the industry will continue to rely heavily on human professionals to oversee, interpret, and create strategies around the insights it provides.

Will AI Replace Accountants and Bookkeepers In the Next 5 Years?

While artificial intelligence is changing the accounting world, there is no evidence to suggest that bookkeepers and accountants will be replaced in the next 5 years.

It’s true that the technology is moving fast, but major breakthroughs would be needed to overcome the current limitations of AI in this space.

As of now, AI excels in carrying out the repetitive and time consuming tasks like invoice processing, reconciling accounts, and generating basic financial reports. But these tasks are only a small part of what bookkeepers and accountants do.

Areas such as strategic financial planning and interpreting nuanced situations that can impact a firm financially are areas that AI is yet to perform well in. These accounting jobs won’t be severely impacted.

Also, the current state of AI technology requires vast amounts of clean structured data to work. Inaccurate or incomplete data can prove very costly, especially if it leads to the wrong decision being made.

Human judgment is still needed to identify these issues and make informed decisions that are specific to the client in concern.

It’s important to remember that the role of accountants is evolving and not disappearing. As AI becomes a greater part of the workflow, professionals will need to adapt by learning how to use these AI accounting software to increase their productivity.

For AI to completely replace bookkeepers and accountants, we would need significant advancements in the thinking models of AI to fully and confidently replicate human judgment.

This is a possibility in the distant future. However, it’s not likely to happen in the next five years.

What Can Be Automated by AI?

AI bookkeeping is changing accounting by automating the routine, mundane, time consuming tasks so bookkeepers and accountants can focus on the strategic, high value activities.

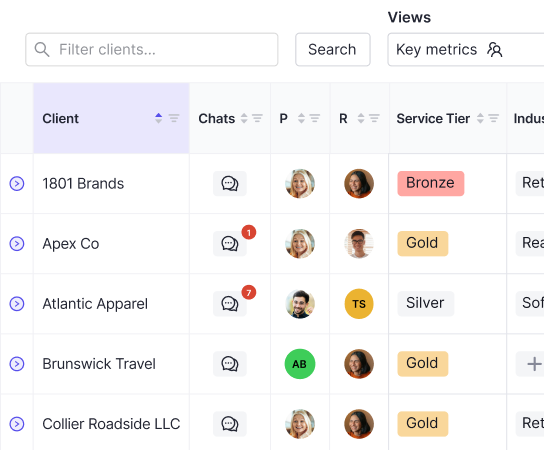

Bookkeeping workflow software tools like Keeper have taken automation to the next level with features that make the accounting process more efficient and accurate.

For example,

bookkeeping transaction reconciliation is a tedious task AI is good at. Keeper automates the categorization and matching of financial transactions, reducing errors and hours of manual work.

By doing this, accountants can quickly ensure financials are accurate and up to date.

Another useful feature is

receipt capture, which eliminates the hassle of paper receipts.

Users can upload receipts via the app and Keeper’s AI will extract and match the data to transactions, so you’re compliant with IRS documentation requirements.

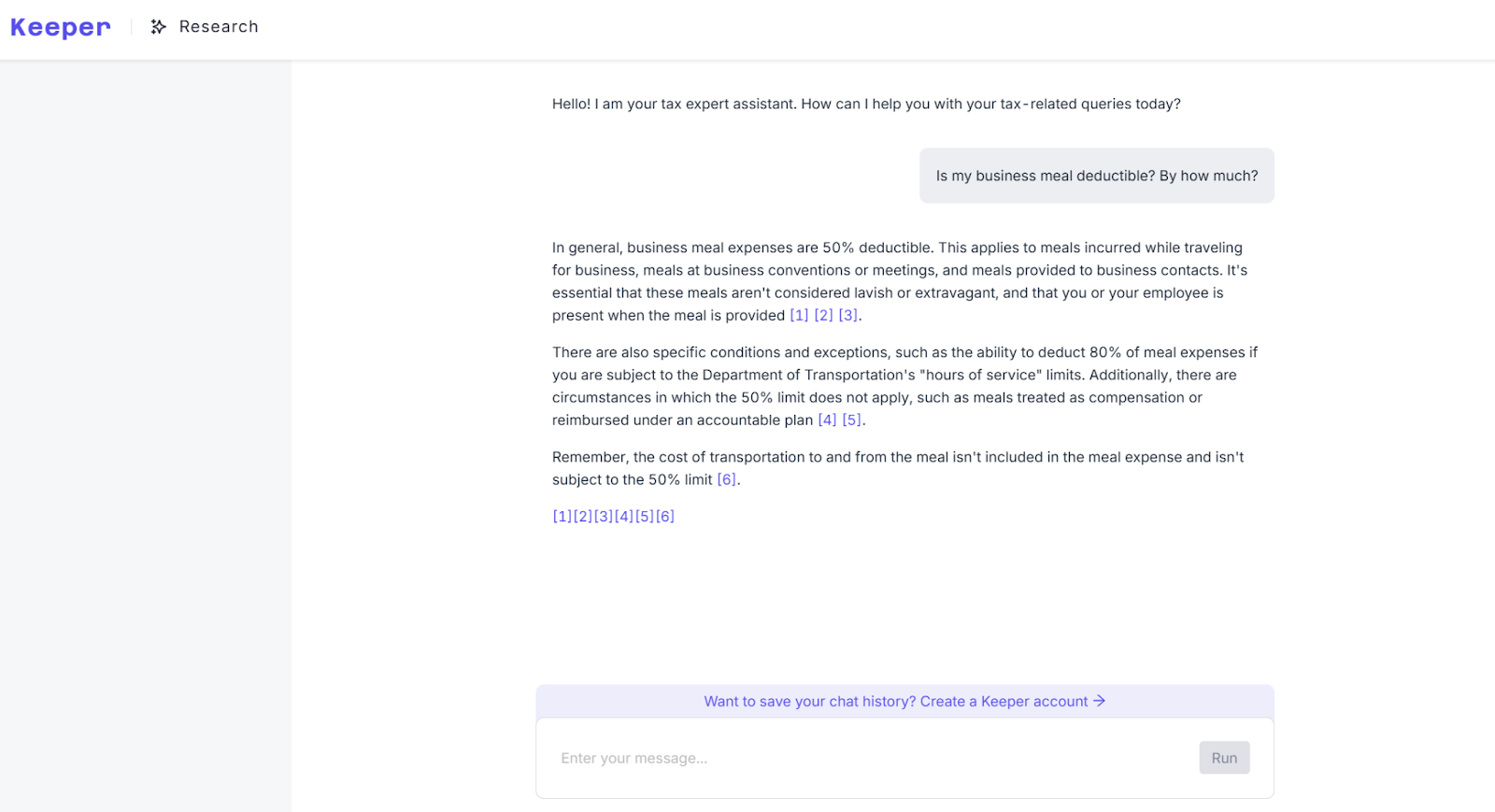

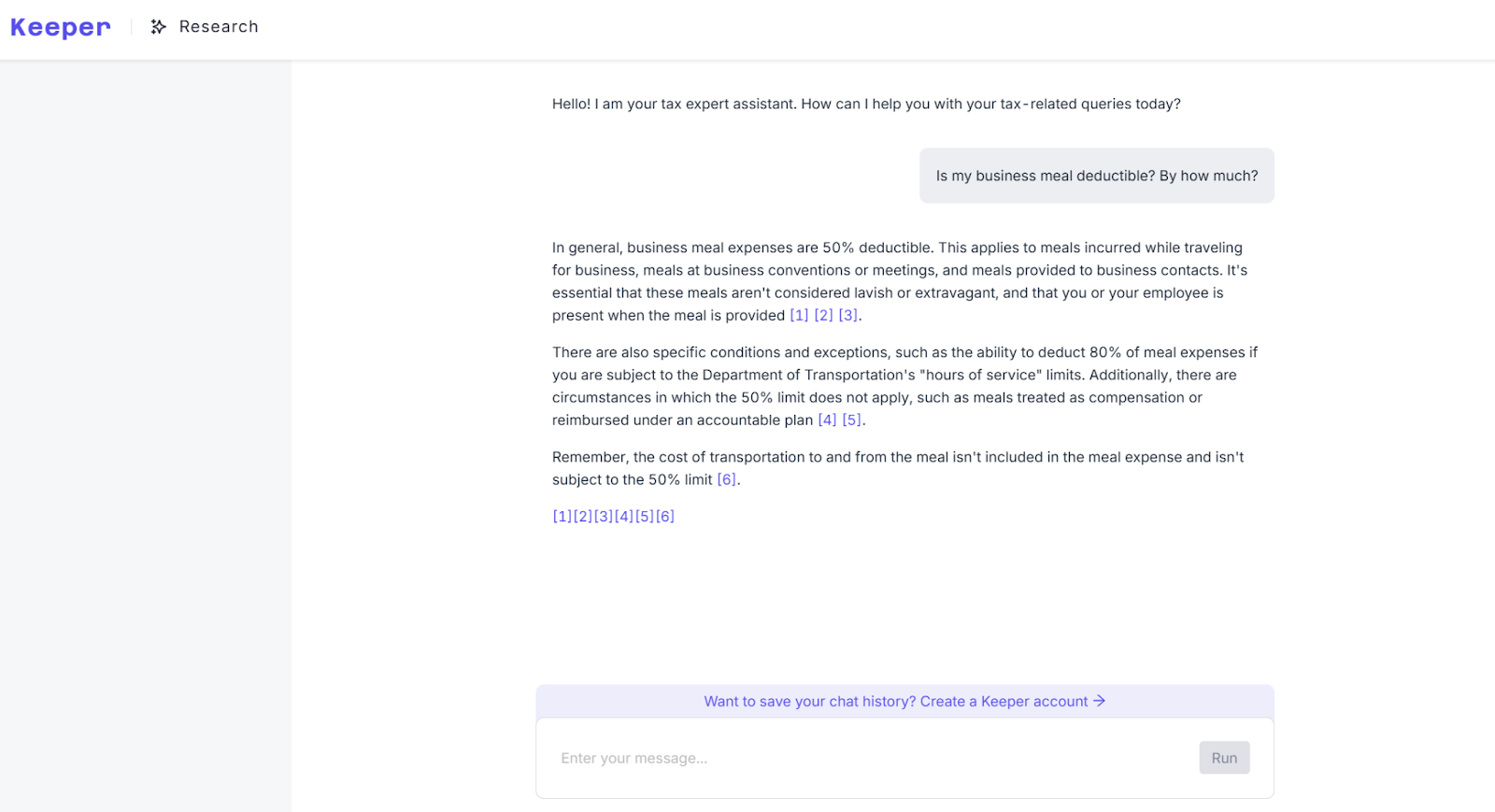

One of Keeper’s newest features is

Keeper Research, a tax research tool powered by AI. (This is free to the public: you don’t have to have a Keeper account to use it!)

Available in the app and online, this tool sits within Keeper’s accounting software and is trained on the Internal Revenue Code and IRS publications. You can ask tax questions—like if a business meal is deductible—and get comprehensive, source-cited answers.

By using Keeper Research in their daily workflow, accountants can save hours on tax research while still maintaining accuracy.

Whether it’s answering tough tax questions or confirming regulations, this is a must-have tool to stay ahead in the accounting game.

Automation through accounting software like Keeper is a testament to how AI can support bookkeepers and accountants to deliver faster, more efficient, and more accurate services to all clients.

What Can’t Be Automated by AI?

While AI is great for efficiency and accuracy for routine accounting tasks, there are areas where human expertise can’t be beat in the accounting profession.

These tasks require creativity, empathy, and the nuance that only experienced professionals and account teams can bring where AI outputs cannot compete.

These include:

Human Creativity

- AI can’t replicate the creative solutions accountants and bookkeepers come up with when dealing with unique financial issues.

- For example, when designing a custom tax saving strategy or creating an innovative plan to restructure a business’s finances, human ingenuity is key to getting tailored results.

Client Interactions

- Building trust and relationships is a no-brainer success element in accounting. Clients want reassurance, guidance, and a personal touch when managing their finances.

- While an AI system can help with responses, it can’t replicate the empathy and understanding that human accountants bring to client conversations, especially in difficult times.

Tough Calls

- Financial data needs to be further interpreted in grey areas. For example, deciding how to classify a one off expense or choosing the best long term tax strategy often involves weighing multiple factors.

- AI may give suggestions but lacks the professional judgment and experience to make strategic decisions with context.

High Risk Decisions

- When the stakes are high, like during mergers, acquisitions, or audits, human expertise is required.

- Accountants and bookkeepers are trained to assess risk, present options, and navigate the complexities of these situations with discretion and foresight – something AI can’t do.

Strategic Planning

- AI can crunch data and give insights but it takes human accounting professionals to turn those insights into strategies that align with a client’s objectives.

- Planning for business growth or financial stability requires a level of understanding and foresight that AI doesn’t have.

Will Accountants and Bookkeepers Have to Use AI in the Future?

Yes.

As AI adoption grows across various industries, those in the accounting profession who use it will get ahead.

Using AI automation tools will increase productivity, streamline processes, reduce errors, and improve outcomes for clients. Ignoring AI means falling behind competitors who use it to deliver faster, more accurate, and affordable services.

AI is already changing bookkeeping and accounting with automated transaction categorization, real time data analysis, and intelligent tax research tools.

These let accounting and tax professionals focus on high value tasks like planning, client relationships, and decision making.

Using AI tools like the ones Keeper provides shows that your firm recognizes what is possible in the accounting space and is adapting to it.

By using technological advancements to eliminate the repetitive and mundane elements of work, professionals can then focus on delivering client services and strategic insights while retaining the human touch in the areas that AI can’t help with.

Use Keeper Automation to Improve Your Bookkeeping Workflows

The old adage “time is money” stands true today.

In accounting today, being ahead of the game means using

bookkeeping practice management software that saves time and is accurate.

Keeper does just that with automation features that streamline tedious workflows and free up time for higher level tasks.

Here’s a quick recap on how Keeper can make a difference to the accounting profession:

- Use automated transaction reconciliation to make sure your clients’ financial records are accurate and up to date

- Leverage receipt capture to make document management a breeze

- Tap into Keeper Research to take your tax research to the next level

Are you ready to optimize your advisory services and accounting practice today?

Get started with Keeper now!

Available in the app and online, this tool sits within Keeper’s accounting software and is trained on the Internal Revenue Code and IRS publications. You can ask tax questions—like if a business meal is deductible—and get comprehensive, source-cited answers.

By using Keeper Research in their daily workflow, accountants can save hours on tax research while still maintaining accuracy.

Whether it’s answering tough tax questions or confirming regulations, this is a must-have tool to stay ahead in the accounting game.

Automation through accounting software like Keeper is a testament to how AI can support bookkeepers and accountants to deliver faster, more efficient, and more accurate services to all clients.

Available in the app and online, this tool sits within Keeper’s accounting software and is trained on the Internal Revenue Code and IRS publications. You can ask tax questions—like if a business meal is deductible—and get comprehensive, source-cited answers.

By using Keeper Research in their daily workflow, accountants can save hours on tax research while still maintaining accuracy.

Whether it’s answering tough tax questions or confirming regulations, this is a must-have tool to stay ahead in the accounting game.

Automation through accounting software like Keeper is a testament to how AI can support bookkeepers and accountants to deliver faster, more efficient, and more accurate services to all clients.